How The Netherlands Became World’s First Country With No Stray Dogs on the Streets

Pets, as cherished members of our families, deserve rights and protections that ...

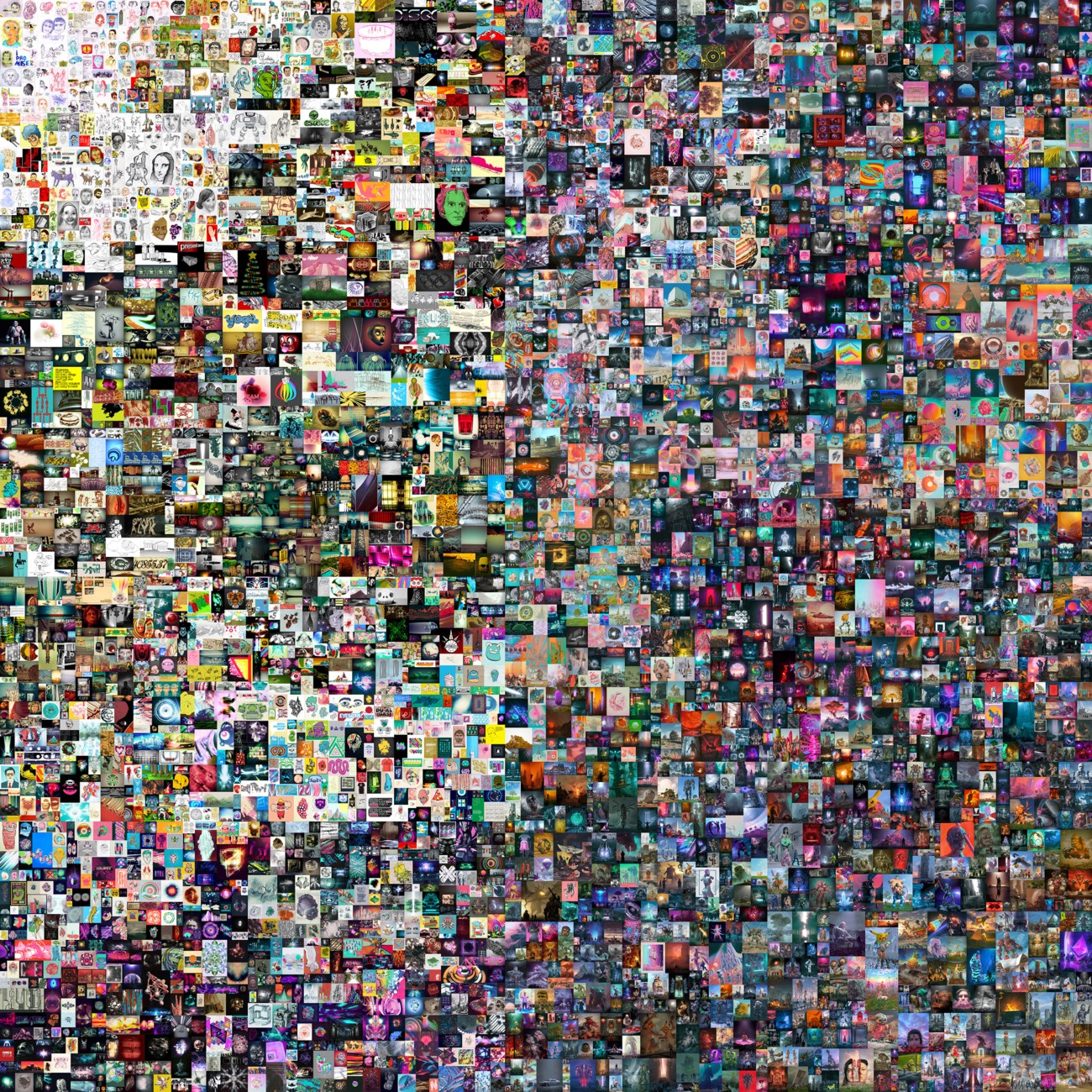

When artist Mike Winkelmann, known in the art-graphics world as Beeple, sold his digital art Everydays:The First 5000 Days, for the astronomical price of US$69.3 million in March 2021, the world of NFTs exploded. Now everyone with an interest in art and the digital realms is talking about NFTs.

An NFT, or Non Fungible Token, is a digital file stored via blockchain, and unlike a dollar note, it is not interchangeable. It can be a visual image, an animation, a song, a piece of poetry, a phrase or any kind of digital data. NFT’s can be bought and sold using cryptocurrency and are tracked on blockchains. The buyer has ownership of the NFT but not the copyright, which still belongs to the creator.

It is said that the first NFT was created as early as 2014. The piece, titled Quantum, was minted by digital artist Kevin McCoy and is now on sale for US$7 million. It had gained a steady following under the radar until Beeple hit the headlines.

Whether you’re an artist or a buyer, you have to be savvy in the metaverse of cryptocurrencies and blockchains and get au fait with an entirely new language featuring words such as dropped, DeFi, minting, metamask, hashmask, hodl, tokenomics and noob.

And, if you think you’re ready to launch yourself into this strange new world, then get yourself a crypto wallet. Are you going for Bitcoin, Ethereum or Cardano? You have to know which currency suits your purpose. Let’s say you want to buy a piece of NFT artwork. The obvious and largest marketplace for this is OpenSea, which trades mainly in Ethereum (1ETH = US$3,000 more or less but it can be highly variable). There are several other platforms or markets such as Axie Infinity and CryptoPunks and some which are more niche such as SuperRare (more curated as artists can only display by invitation and therefore more pricey).

Beeple’s ‘Everydays: The First 5000 Days’

To put it in very simple terms… bragging rights. If you buy a painting and hang it in your bedroom, no one will know about it except you and possibly the artist and whomever you invite into your bedroom. But once you buy an NFT, everyone in the cyber world knows about it. Everyone knows how much you paid for it and how much money you made reselling it and they’ll go “Oh my God! He made that much in a month!”

The traditional way of selling your art is to display it at a gallery where the curator does all the work for you, including promotion, sales and marketing, and then takes a commission on any sale. From that point on, the artwork is out of your hands… and you go back to your paints and brushes to create a new piece.

With NFTs however, you—the artist—are in charge. Not only do you have to create the piece of work, you also have to create the story behind it, write up the description that will become part of the NFT, set a price and “socialise” with a target community of artists, buyers, curators and others on platforms such as Discord so as to keep updated with the current environment in the NFT metaverse: what people are looking for, who’s in trend, what are the going prices, is it time to drop another piece?

A good example is graphic artist Puen, or Sattrawut Sinlapaanun. A gaming enthusiast since childhood, parental rules prevented him from playing so he went for the next best thing—reading gaming comics and drawing their characters. Though he didn’t study art, he continued drawing and posting his illustrations on social media and after 10 long years his 3D characters gradually attracted the notice of an NFT platform. It approached him out of the blue by email in 2019. Puen had not a clue what an NFT was, at first assuming the message was spam. Intrigued though, he began conducting some research.

He minted his first NFT on the theme of mental health in early 2021, but after three months he still didn’t have any takers. He realised it was too complicated and what people liked about his work was his original 3D gaming characters. So he challenged himself to come up with as many characters as he could in 100 days. He posted them and asked his followers to name them, thereby engaging others and creating an interactive project. He ended up with 50 characters that he combined into one big piece called Monsters. He also had to create a story for the characters: upon the death of the Dark Lord, or Boss in usual gaming terms, the monster army has been scattered and is attempting to reunite.

Monsters sold for 0.165ETH, or approximately 20,000 baht. What followed, however, was much more exciting. Puen then minted the characters individually and “dropped” them gradually, in small batches, a marketing strategy that top brands everywhere use to create a buzz for new products. With the initial price set at a moderate 0.05ETH, he has seen some astronomical leaps—one favourite character asking a resale price of 11ETH (1.15 million baht) within a month.

To create successful NFTs, according to Puen you need to consider four elements. Quality of the work (his characters are deceptively simple but are recognized by their shine and 3D qualities); tokenomics (the balance between demand and supply); collector (the artist has to communicate and interact with collectors, unlike in the traditional art world); and community (or networking with other artists, collectors and curators rather than working independently). This is truly a decentralisation of the art world.

This is not just a matter for a new generation of graphic artists. Just as art has evolved from cave painting to murals, to canvases, to video art and installations, this is just a new medium that is taking off like Virgin Galactic. Though some traditional artists might view it with a tinge of scorn, others like Damien Hirst have really embraced it… and very cleverly at that.

Recently Hirst transformed 10,000 similar pieces of artwork of coloured dots—appropriately named The Currency—into tokens, each with his signature, a number, a catchy title to make them unique, plus a watermark, a microdot and a hologram to prevent forgery. He offered art enthusiasts worldwide a chance to own the pieces through a draw and lucky winners had to pay US$2,000 each. An additional gimmick was that the buyers had one year to choose whether they want to keep the token or the physical work, the rejected medium then being destroyed. Within two months the secondary sale prices of the NFTs had risen to US$50,000 and one piece was apparently sold for US$120,000. Not only has Hirst’s project given credibility to NFTs as a new art platform, it has also confirmed his marketing genius and ability to create wider access to his work in the art world.

The media industry has also been quick on the uptake. Fortune magazine’s August-September 2021 front cover, a piece titled Crypto vs. Wall Street by graphic artist pplpleasr was minted as an NFT that fetched 429ETH (US$1.3 million), with resale prices reaching up to seven times the original listing price.

Very cautiously, advise leading art collectors such as Disaphol Chansiri, founder of DC Collection in Chiang Mai, who explained that collecting art should start with personal preferences. There is no right or wrong. What is required, however, is doing a lot of reading and research, acquiring as much knowledge as you can, meeting people in related fields to exchange ideas and perspectives, training yourself to know what you like and what to look for. What you end up buying should be something that gives you joy and the price should not be a consideration. Expensive does not necessarily mean good.

However, if you’re buying art as a form of investment then it’s a whole new ball game. You need to do even more homework than before, since it is now a job, a money-earning activity. You need to study the market, the tokenomics, the work, the artist, the entire metaverse. And unlike traditional currency or artwork, the value could fluctuate immensely, depending on demand for the work and the exchange rate of the cryptocurrencies. So it’s definitely a high-risk investment that requires a cautious tread. But then, it might be worth it for those bragging rights alone.

Pets, as cherished members of our families, deserve rights and protections that ...

These top 5 barber shops in Bangkok are where gentlemen can elevate ...

Sailorr and Molly Santana’s black grills fuse hip-hop swagger with homage to ...

Wandering around the globe, try out the signature tastes of cultures across ...

Once punk was a middle finger to the establishment, with Vivienne Westwood ...

You’ve seen their art, but do you know the pain behind it? ...

Wee use cookies to deliver your best experience on our website. By using our website, you consent to our cookies in accordance with our cookies policy and privacy policy